Bonus paycheck calculator

Plug in the amount of money youd like to take home. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings.

Free Paycheck Calculator Hourly Salary Usa Dremployee

Federal Bonus Tax Percent Calculator.

. Determine your annual income. Make Your Payroll Effortless and Focus on What really Matters. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare.

Ad Compare 5 Best Payroll Services Find the Best Rates. As many individuals do check your most current pay stub if you dont already know your annual wage. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and.

Important note on the salary paycheck calculator. The New York bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Or Select a state.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Gross earnings per pay period Filing status. This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses.

This bonus tax aggregate calculator uses your last paycheck amount to apply the correct withholding rates to special wage. All other pay frequency inputs are assumed to. With this tax method the IRS taxes your bonus at a flat-rate of 25 percent whether you receive 5000 500 or 50 however if your bonus is more than 1 million the tax rate is 396.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Federal Salary Paycheck Calculator. Your employer withholds a 62 Social Security tax and a.

Use this calculator to help determine your net take-home pay from a company bonus. The Viventium Bonus Calculator uses your last paycheck amount to apply the correct withholding rates to special wage payments such as bonuses. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Bonus Pay Calculator Tool.

Amount of bonus Pay period frequency. Federal Bonus Tax Aggregate Calculator. It can also be used to help fill steps 3 and 4 of a W-4 form.

Use the number of pay periods in. Get an accurate picture of the employees gross pay. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

If your state does. The California bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

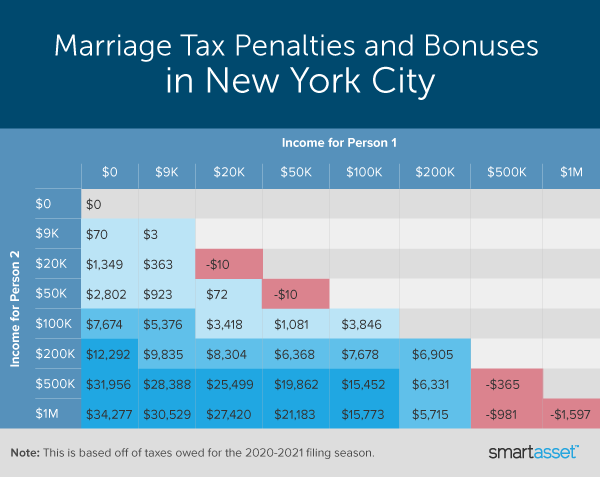

Marriage Penalty Vs Marriage Bonus How Taxes Work

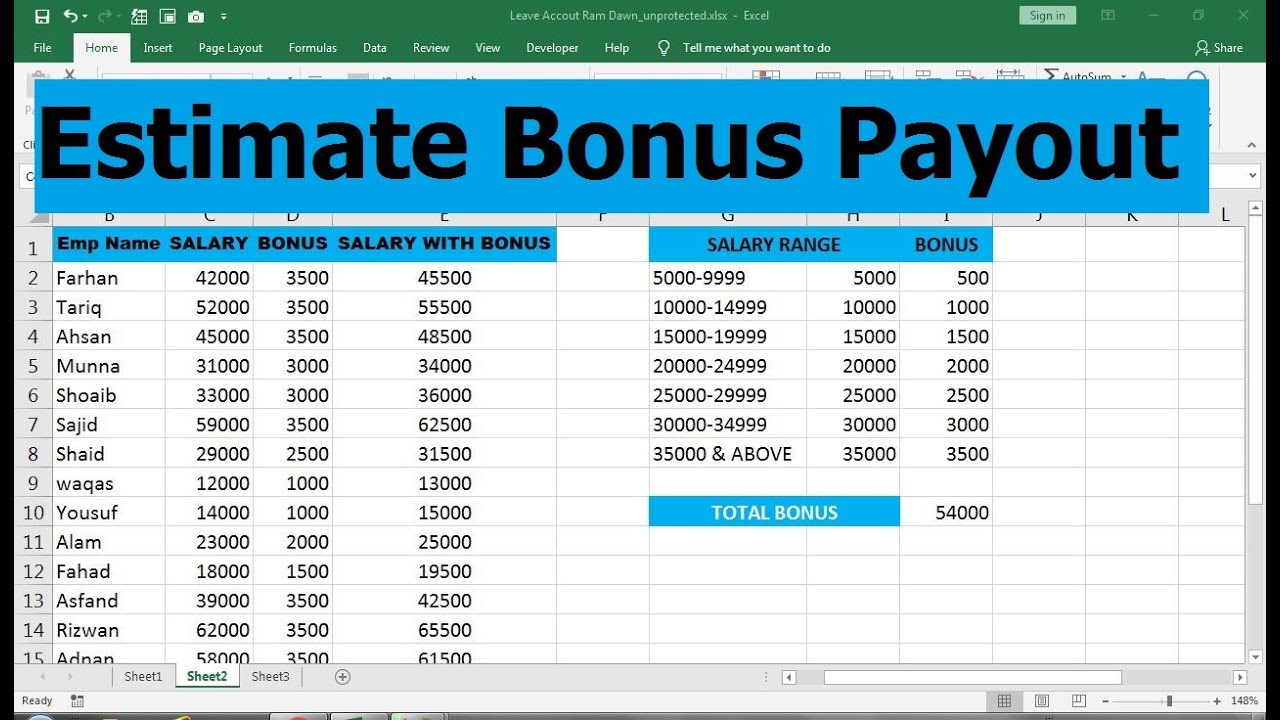

Bonus Calculation Excel Sheet Youtube

Bonus Calculator Percentage Method Primepay

What Are Marriage Penalties And Bonuses Tax Policy Center

How Bonuses Are Taxed Calculator The Turbotax Blog

Avanti Bonus Calculator

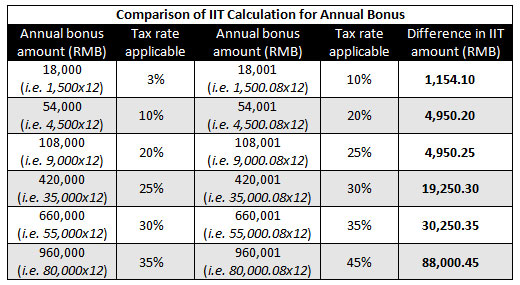

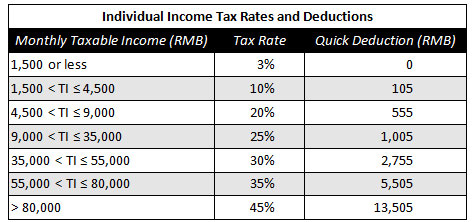

Calculating Individual Income Tax On Annual Bonus In China China Briefing News

Calculating Individual Income Tax On Annual Bonus In China China Briefing News

Calculate Bonus In Excel Using If Function Youtube

China Annual One Off Bonus What Is The Income Tax Policy Change

Flat Bonus Pay Calculator Flat Tax Rates Onpay

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

Bonus Tax Rates Aggregate Bonus Pay Calculator Onpay

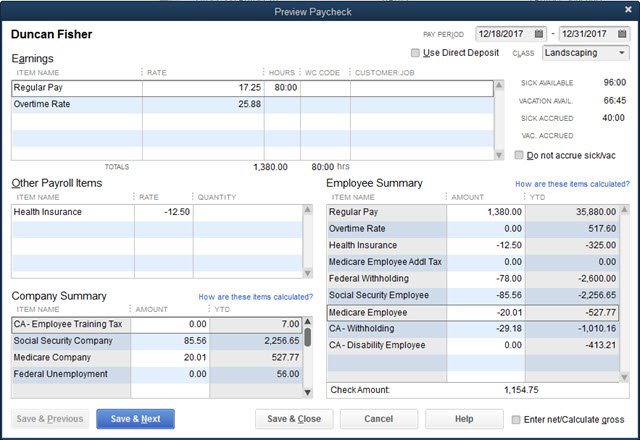

What If I Need To Pay Specific Amounts As A Payroll Holiday Bonus Insightfulaccountant Com

How To Calculate Bonuses For Employees

What Is The Bonus Tax Rate For 2022 Hourly Inc

How Bonuses Are Taxed Calculator The Turbotax Blog