Company payroll tax calculator

Family Trust Interposed Entity Elections. It only takes a few seconds to calculate the right amount to deduct from each employees paycheck thus saving you time and providing peace of mind.

Understanding Payroll Taxes And Who Pays Them Smartasset

Payroll Tax Western Australia This is general information and not advice.

. Gusto Capital LLC NMLS ID. Free 2022 Employee Payroll Deductions Calculator. Company About Us Awards Testimonials Partner with Us Join our Team Modules Payroll Attendance and Time-Tracking.

For more information see WA Department of Finance. This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts. Check personal exemption or family exemption if any of them applies.

Pre-Tax WithholdingsSuch as 401k or FSA accounts that are exempt from payroll tax. With this calculator its easier to plan for the future and prevent mistakes thus giving you peace of mind that youre making all the right payroll decisions. FICA Part 2 Medicare Tax.

The amount can be hourly daily weekly monthly or even annual earnings. Sage Tax Calculator Try our easy-to-use income tax calculator aligned to the latest Budget Speech announcements. Press News Investors Contact Affiliate program Licenses.

Automatic deductions and filings direct deposits W-2s and 1099s. Tax rates 2021-22 calculator. Enter your pay rate.

Calculate your payroll tax quickly and easily using this payroll tax calculator from Ayers Group. Effective payroll management solutions start with Ayers. Phone 1300 767 391.

Use this simplified payroll deductions calculator to help you determine your net paycheck. Or if youre already a sole trader enter your annual profits to calculate the amount you might save by incorporating a limited company. About Careers Were hiring.

Figures are based on a full tax year. Deduct these withholdings in order to come up with taxable income. Figure the tentative tax to withhold.

Once you have the adjusted annual wages you can use the tax table found on page 6 of IRS Pub 15-T and calculate the annual federal income tax amount. Note that if you pay state unemployment taxes in full and on time you are eligible for a tax credit of up to 54 which brings your effective FUTA tax rate to 06. Account for dependent tax credits.

Our payroll tax calculator is designed to help you quickly calculate payroll deductions and withholdings for your employees. You can use the calculator to compare your salaries between 2017 and 2022. This calculator assumes that.

Deduct and match any FICA taxes. Estimate your annual profits to work out if registering your business as a limited company or as a sole trader is more tax efficient. We wont go into all the.

Usage of the Payroll Calculator. Use this payroll tax calculator to see how adding new employees will affect your payroll taxes. Digital Tools Sage has put together key business resources to assist and enable you in the successful running of your business.

Super contribution caps 2021 - 2022 - 2023. FBT Fringe Benefits Tax. Why Gusto Payroll and more Payroll.

Tax rates 2022-23 calculator. Calculate the FUTA Unemployment Tax which is 6 of the first 7000 of each employees taxable income. The calculator is updated with the tax rates of all Canadian provinces and territories.

Sage Business Cloud Adviser Portal Providing you with the tools to become a trusted Partner. Employer Paid Payroll Tax Calculator With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start. Calculate your income tax in Jordan using ZenHRs Jordan Tax Calculator.

Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. Employee Self-Service ESS. FICA Part 1 Social Security Tax.

Finally you can make any needed tax adjustments for dependents and determine the amount of tax per check. Federal Income TaxThe biggest tax of them all which can range from 0 all the way to 37.

Payroll Deductions Calculator Stores 61 Off Aarav Co

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

How To Do Payroll In Excel In 7 Steps Free Template

How To Calculate Payroll Taxes Methods Examples More

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

How To Do Payroll In Excel In 7 Steps Free Template

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

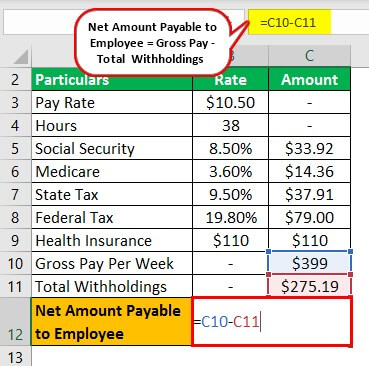

Payroll Formula Step By Step Calculation With Examples

How To Do Payroll In Excel In 7 Steps Free Template

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate Payroll Taxes Methods Examples More

How To Do Payroll In Excel In 7 Steps Free Template

Payroll Formula Step By Step Calculation With Examples

How To Do Payroll In Excel In 7 Steps Free Template

Hiring And International Peo Services Biz Latin Hub

How To Do Payroll In Excel In 7 Steps Free Template